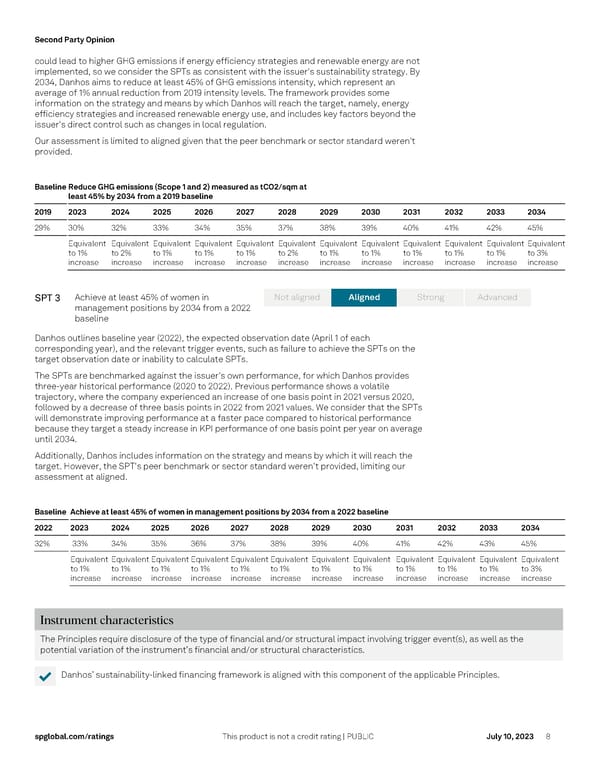

Second Party Opinion s pglobal.com/ ratings This product is not a credit rating | PUBLIC July 10, 2023 8 could lead to higher GHG emissions if energy efficiency strategies and renewable energy are not implemented, so we consider the SPTs as consistent with the issuer's sustainability strategy. By 2034, Danhos aims to reduce at least 45% of GHG emissions intensity, which represent an average of 1% annual reduc tion from 2019 intensity levels. The framework provides some information on the strategy and means by which Danhos will reach the target, namely, energy efficiency strategies and increased renewable energy use, and includes key factors beyond the issuer's direct control such as changes in local regulation. Our assessment is limited to aligned given that the peer benchmark or sector standard weren't provided. Baseline Re duce GHG emissions (Scope 1 and 2) measured as t CO2/sqm at least 45% by 2034 from a 2019 baseline 2019 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 29% 30% 32% 33% 34% 35% 37% 38% 39% 40% 41% 42% 45% Equivalent to 1% increase Equivalent to 2% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 2% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 3% increase SPT 3 Achieve at least 45% of women in management positions by 2034 from a 2022 baseline Danhos outlines baseline year (2022), the expected observation date (April 1 of each corresponding year), and the relevant trigger events, such as failure to achieve the SPT s on the target observation date or inability to calculate SPT s. The SPTs are benchmarked against the issuer 's own performance, for which Danhos provides three -year historical performance (2020 to 2022). Previous performance shows a volatile trajectory, where the company experienced an increase of one basis point in 2021 ve rsus 2020, followed by a decrease of three basis points in 2022 from 2021 values. We consider that the SPTs will demonstrate improving performance at a faster pace compared to historical performance because they target a steady increase in KPI performance of one basis point per year on average until 2034 . Additionally, Danhos includes information on the strategy and means by which it will reach the target . However, the SPT's peer benchmark or sector standard weren't provided, limiting our assessment at aligned. Baseline Achieve at least 45% of women in management positions by 2034 from a 2022 baseline 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 32% 33% 34% 35% 36% 37% 38% 39% 40% 41% 42% 43% 45% Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 1% increase Equivalent to 3% increase Instrument characteristics The Principles require disclosure of the type of financial and/or structural impact involving trigger event(s), as well as the potential variation of the instrument’s financial and/or structural characteristics. ✔ Danhos ’ sustainability -linked financing framework i s aligned with this component of the applicable Principles . Aligned No t aligned St rong Ad vanced

Fibra Danhos' Sustainability Linked Financing Framework Page 7 Page 9

Fibra Danhos' Sustainability Linked Financing Framework Page 7 Page 9