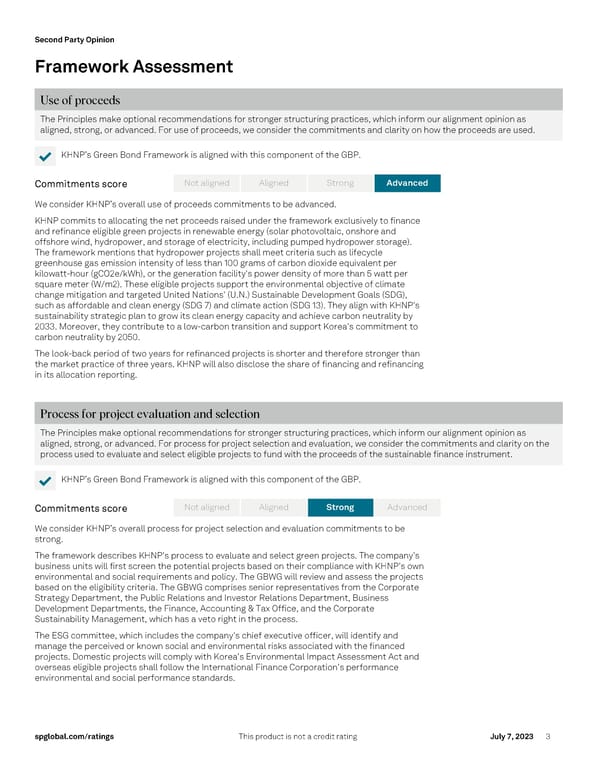

Second Party Opinion s pglobal.com/ ratings This product is not a credit rating Ju ly 7 , 2023 3 Framework Assessment Use of p roceeds The Principles make optional recommendations for stronger structuring practices, which inform our alignment opinion as aligned , strong, or advanced. For u se of p roceeds, we consider the commitments and clarity on how the proceeds are used. ✔ KHNP ’s Green Bond Framework is aligned with this component of the GBP. Commitments score We consider KHNP ’s overall use of proceeds commitments to be advanced. KHNP commits to allocat ing the net proceeds raised under the framework exclusively to finance and refinance eligible green projects in renewable energy ( solar photovoltaic, onshore and offshore wind , hydropower , and storage of electricity , including pumped hydropower storage) . The framework mentions that hydropower projects shall meet criteria such as lifecycle greenhouse gas emission intensity of less than 100 grams of carbon dioxide equivalent per kilowatt -hour (gCO2e/kWh) , or the generation facility's power density of more th an 5 watt per square meter (W/m2) . These eligible projects support the environmental objective of climate change mitigation and targeted United Nations' (U.N.) S ustainable Development Goals (SDG) , such as affordable and clean energy (SDG 7) and climate act ion (SDG 13) . They align with KHNP's sustainability strategic plan to grow its clean energy capacity and achieve carbon neutrality by 2033. Moreover, they contribute to a low -carbon transition and support Korea's commitment to carbon neutrality by 2050 . The look -back period of two years f or refinanced projects is shorter and therefore stronger than the market practice of three years. KHNP will also disclose the share of financing and refinancing in its allocation reporting. Process for project evaluation and selection The Principles make optional recommendations for stronger structuring practices, which inform our alignment opinion as aligned , strong, or advanced. For p rocess for p roject selection and evaluation, we consider the commitments and clarity on the process used to evaluate and select eligible projects to fund with the proceeds of the sustainable finance instrument . ✔ KHNP ’s Green Bond Framework is aligned with this component of the GB P. Commitments score We consider KHNP ’s overall process for project selection and evaluation commitments to be strong . The framework describes KHNP 's process to evaluate and select green projects. The company's business units will first screen the potential projects based on their compliance with KHNP's own environmental and social requirements and policy. The GBWG will review and assess the projects based on the eligibility criteria. The GBWG comprises senior representatives from the Corporate Strategy Department, the Public Relations and Investor Relations Department, Business Development Departments, the Finance, Accounting & Tax Office, and the Corporate Sustainability Management , which has a ve to right in the process. The ESG committee, which includes the company's chief executive officer, will identify and manage the perceived or known social and environmental risks associated with the financed projects. Domestic projects will comply with Korea 's Environmental Impact Assessment Act and overseas eligible projects shall follow the International Finance Corporation 's performance environmental and social performance standards. Aligned No t aligned St r ong Ad vanced Aligned Not aligned St r ong Ad vanced

Korea Hydro & Nuclear Power Co. Ltd.'s Green Bond Framework Page 2 Page 4

Korea Hydro & Nuclear Power Co. Ltd.'s Green Bond Framework Page 2 Page 4