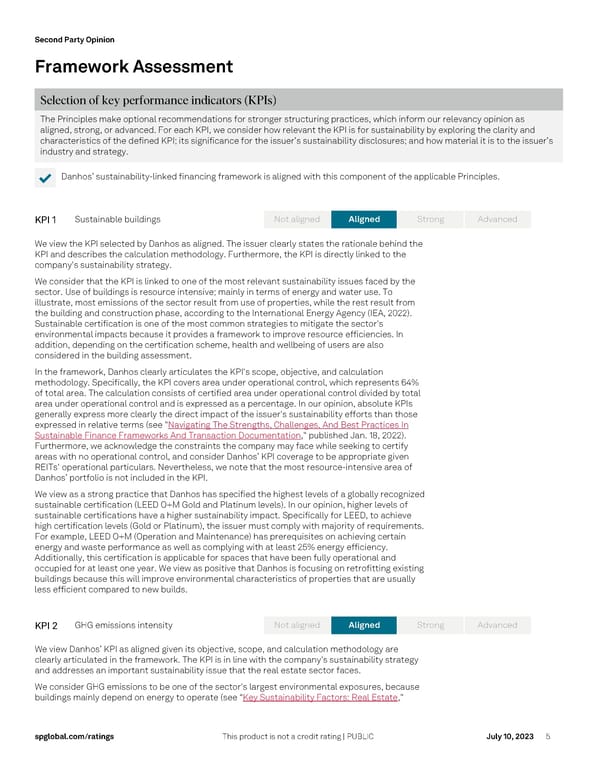

Second Party Opinion s pglobal.com/ ratings This product is not a credit rating | PUBLIC July 10, 2023 5 Framework Assessment Selection of key performance indicators (KPIs) The Principles make optional recommendations for stronger structuring practices, which inform our relevancy opinion as aligned , strong, or advanced. For each KPI, we consider how relevant the KPI is for sustainability by exploring the clarity and character istics of the defined KPI; its significance for the issuer’s sustainability disclosures; and how material it is to the issuer’s industry and strategy. ✔ Danhos ’ sustainability -linked financing framework is aligned with this component of the applicable Principles . KPI 1 Sustainable buildings We view the KPI selected by Danhos as aligned. T he issuer clearly states the rationale behind the KPI and describes the calculation methodology . Further more , the KPI is directly linked to the company 's sustainability strategy. We consider that the KPI is linked to one of the most relevant sustainability issues faced by the sector. Use of buildings is resource intensive; mainly in terms of energy and water use. To illustrate, m ost emissions of the sector result from use of properties, while the rest result from the building and construction phase, according to the International Energy Agency (IEA, 2022). Sustainable certification is one of the most common strategies to mitigate the sector's environmental impacts because it provides a framework to improve resource efficiencies. In addition, depending on the certification scheme, health and wellbeing of users are also considered in the building assessment. In the framework, Danhos clearly articulate s the KPI's scope, objective, and calculation methodology. Specifically, the KPI covers area under operational control, which represents 64% of total area. The calculation consists of certified area under operational control divided by total area unde r operational control and is expressed as a percentage. In our opinion, absolute KPIs generally express more clearly the direct impact of the issuer's sustainability efforts than those expressed in relative terms (see " Navigating The Strengths, Challenges, And Best Practices In Sustainable Finance Frameworks And Transaction Documentation ," published Jan. 18, 2022). Furthermore, w e acknowledge the constraints the company may face while seeking to certify areas with no operational control , and consider Danho s’ KPI coverage to be appropriate given REIT s' operational particulars . Nevertheless, we note that the most resource -intens ive area of Danhos ’ portfolio is not included in the KPI. We view as a strong practice that Danhos has specified the highest levels of a globally recognized sustainable certifi cation (LEED O+M Gold and Platinum levels) . In our opinion, higher levels of sustainable certifications h ave a higher sustainability impact . Specifically for LEED, to achieve high certification levels (Gold or Platinum), the issuer m ust comply with majority of requirements . For example, LEED O+M (Operation and Maintenance) ha s prerequisites on achieving certain energy and waste performance as well as complying with at least 25% energy efficiency . Additionally, this certification is app licable for spaces that have been fully operational and occupied for at least one year . W e view as positive that Danhos is focusing on retrofitting existing buildings because this will improve environmental characteristics of properties that are usually less efficient compared to new builds. KPI 2 GHG emissions intensity We view Danhos’ KPI as aligned given its objective, scope, and calculation methodology are clearly articulated in the framework. The KPI is in line with the company's sustainability strategy and addresses an important sustainability issue that the real estate sector faces. We consider GHG emissions to be one of the sector's largest environmental exposures , because bui ldings mainly depend on energy to operate (see “ Key Sustainability Factors: Real Estate ," Aligned No t aligned St rong Ad vanced Aligned No t aligned St rong Ad vanced

Fibra Danhos' Sustainability Linked Financing Framework Page 4 Page 6

Fibra Danhos' Sustainability Linked Financing Framework Page 4 Page 6