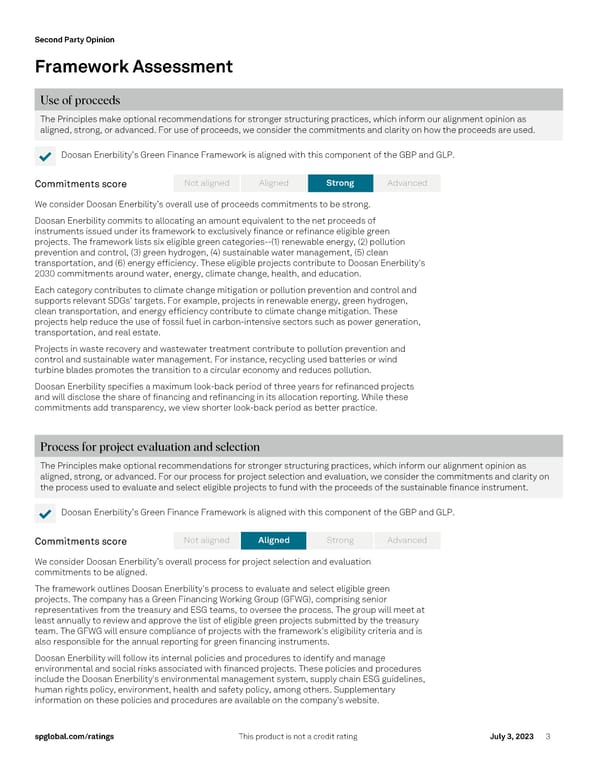

Second Party Opinion s pglobal.com/ ratings This product is not a credit rating J u ly 3 , 2 023 3 Framework Assessment Use of proceeds The Principles make optional recommendations for stronger structuring practices, which inform our alignment opinion as aligned , strong, or advanced. For use of p roceeds, we consider the commitments and clarity on how t he proceeds are used. ✔ Doosan Enerbility ’s Green Finance Framework is aligned with this component of the GBP and GLP. Commitments score We consider Doosan Enerbility ’s overall use of proceeds commitments to be strong . Doosan Enerbility commits to allocating an amount equivalent to the net proceeds of instruments issued under its framework to exclusively finance or refinance eligible green projects. The framework list s six eligible green categories --( 1) renewable energy, ( 2) pollution prevention and control , (3) green hydrogen, ( 4) sustainable water management, ( 5) clean transportation, and (6 ) energy efficiency. These eligible projects contribute to Doosan Enerbility's 2030 commitments around water, energy, climate change, health , and education. Each category contributes to climate change mitigation or pollution prevention and control and support s relevant SDGs ' targets. For example, projects in renewable energy, green hydrogen, clean transportation, and energy efficiency contribute to climate change mitigation. These projects help reduce the use of fossil fuel in carbon -intensive sectors such as power generation, transportation, and real estate. Projects in waste recov ery and wastewater treatment contribute to pollution prevention and control and sustainable water management . For instance, recycling used batteries or wind turbine blades promotes the transition to a circular economy and reduces pollution. Doosan Enerbility specifies a maximum look -back period of three years for refinanced projects and will disclose the share of financing and refinancing in its allocation reporting . While t hese co mmitments add transparency, we view shorter look -back period as better practice. Process for project evaluation and selection The Principles make optional recommendations for stronger structuring practices, which inform our alignment opinion as aligned , strong, or advanced. For our process for p roject selection and e valuation, we consider the commitments and clarity on the process used to evaluate and select eligible projects to fund with the proceeds of the sustainable finance instru ment . ✔ Doosan Enerbility ’s Green Finance Framework is aligned with this component of the GBP and GLP. Commitments score We consider Doosan Enerbility’s overall process for project selection and evaluation commitments to be aligned . The framework outlines Doosan Enerbility's process to evaluate and select eligible green projects . The company has a Green Financing Working Group (GFWG) , comprising senior representatives from the treasury and ESG teams , to oversee the process. The group will meet at least annually to review and approve the list of eligible green projects submitted by the treasury team. The GFWG will ensure compliance of projects with the framework's eligibility criteria and is also responsible for the annual reporting for green financing instruments . Doosan Enerbility will follow its internal policies and procedures to identify and manage environmental and social risks associated with financed projects. These policies and procedures include the Doosan Enerbility's environmental management system, supply chain ESG guidelines, human rights policy, environment, health and safety policy, among others . Supplementary information on these policies and procedures are available on the company's website. Aligned No t aligned St r ong Ad vanced Aligned No t aligned St r ong Ad vanced

Doosan Enerbility Co. Ltd.'s Green Finance Framework Page 2 Page 4

Doosan Enerbility Co. Ltd.'s Green Finance Framework Page 2 Page 4