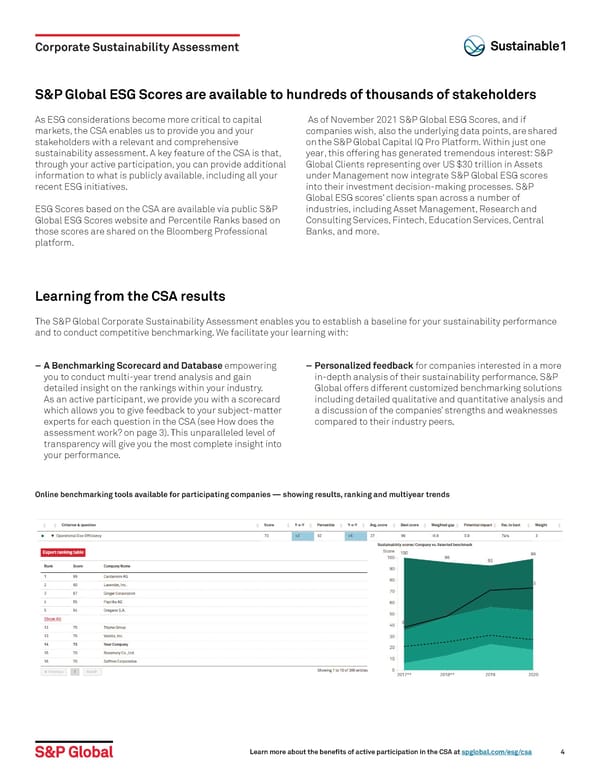

− A Benchmarking Scorecard and Database empowering you to conduct multi-year trend analysis and gain detailed insight on the rankings within your industry. As an active participant, we provide you with a scorecard which allows you to give feedback to your subject-matter experts for each question in the CSA (see How does the assessment work? on page 3). This unparalleled level of transparency will give you the most complete insight into your performance. − Personalized feedback for companies interested in a more in-depth analysis of their sustainability performance. S&P Global offers different customized benchmarking solutions including detailed qualitative and quantitative analysis and a discussion of the companies’ strengths and weaknesses compared to their industry peers. The S&P Global Corporate Sustainability Assessment enables you to establish a baseline for your sustainability performance and to conduct competitive benchmarking. We facilitate your learning with: Online benchmarking tools available for participating companies — showing results, ranking and multiyear trends S&P Global ESG Scores are available to hundreds of thousands of stakeholders As ESG considerations become more critical to capital markets, the CSA enables us to provide you and your stakeholders with a relevant and comprehensive sustainability assessment. A key feature of the CSA is that, through your active participation, you can provide additional information to what is publicly available, including all your recent ESG initiatives. ESG Scores based on the CSA are available via public S&P Global ESG Scores website and Percentile Ranks based on those scores are shared on the Bloomberg Professional platform . Learning from the CSA results Corporate Sustainability Assessment As of November 2021 S&P Global ESG Scores, and if companies wish , also the underlying data points, are shared on the S&P Global Capital IQ Pro Platform. Within just one year , this offering has generated tremendous interest: S&P Global Clients representing over US $ 30 trillion in Assets under Management now integrate S&P Global ESG scores into their investment decision-making processes. S&P Global ESG scores’ clients span across a number of industries, including Asset Management, Research and Consulting Services, Fintech, Education Services, Central Banks, and more. Learn more about the benefits of active participation in the CSA at spglobal.com/esg/csa 4

Corporate Sustainability Assessment Page 3 Page 5

Corporate Sustainability Assessment Page 3 Page 5