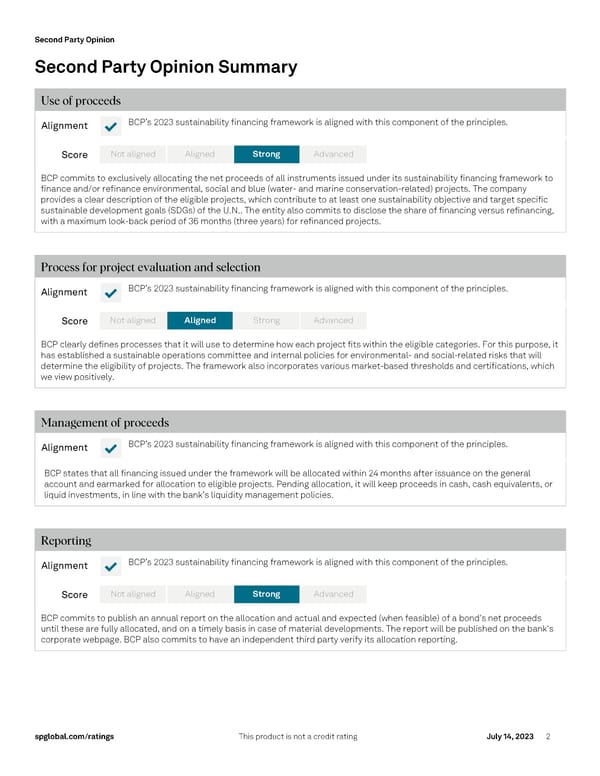

Second Party Opinion s pglobal.com/ ratings This product is not a credit rating July 14, 2023 2 Second Party Opinion Summary Use of proceeds Alignment ✔ BCP ’s 2023 sustainability financing framework is aligned with this component of the p rinciples. Score BCP commits to exclusively allocating the net proceeds of all instruments issued under its sustainability financing framework to finance and/or refinance environmental , social and blue (water - and marine conservation-related) projects. The company provides a clear description of the eligible projects, which contribute to at least one sustainability objective and target specific sustainable development goals (SDGs) of the U.N.. Th e entity also commits to disclose the share of financing versus refinancing, with a maximum look- back period of 36 months ( three years) for refinanced projects. Process for project evaluation and selection Alignment ✔ BCP ’s 2023 sustainability financing framework is aligned with this component of the principles . Score BCP clearly defines processe s that it will use to determine how each project fits within the eligible categories. For this purpose, it has established a sustainable operations committee and internal policies for environmental - and social -related risks that will determine the eligibility of projects. The framework also incorporates various market -based thresholds and certifications, which we view positively. Management of proceeds Alignment ✔ BCP ’s 2023 sustainability financing framework is aligned with this component of the p rinciples. BCP states that all financing issued under the framework will be allocated within 24 months after issuance on the general account and earmarked for allocation to eligible projects. Pending allocation, it will keep proceeds in cash , cash equivalents , or liquid investments , in line with the bank’s liquidity management policies. Reporting Alignment ✔ BCP ’s 2023 sustainability financing framework is aligned with this component of the p rinciples. Score BCP commits to publish an annual report on the allocation and act ual and expected (when feasible) of a bond's net proceeds until these are fully allocated, and on a timely basis in case of material developments . The report will be published on the bank's corporate webpage. BCP also commits to have an independent third p arty verify its allocation reporting . Aligned No t aligned Str ong Ad vanced Aligned No t aligned St rong Ad vanced Aligned No t aligned Str ong Ad vanced

Banco de Crédito del Perú's 2023 Sustainability Financing Framework Page 1 Page 3

Banco de Crédito del Perú's 2023 Sustainability Financing Framework Page 1 Page 3